How much longer will we need to exchange money at the airport? What payment methods will we use in the future?

Bernhard Haslhofer, who leads a research group at the Complexity Science Hub, is involved in studying digital assets and analyzing global financial flows. At this year’s European Forum Alpbach (EFA), he co-leads a five-day seminar titled “Envisioning the Future of Money.”

Here’s the expert’s interview:

Q: WHAT IS THE MAIN FOCUS OF THE SEMINAR?

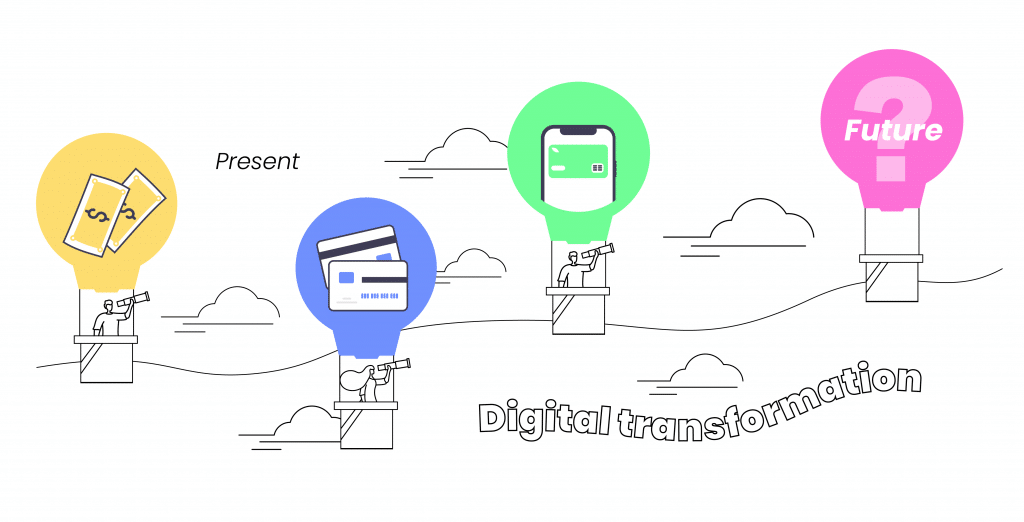

BH: We are in the midst of a digital transformation that will significantly impact our concept of money and how we conduct transactions. The ultimate destination of this journey remains uncertain.

In the seminar, our aim is to spend a week with a diverse group of 30 motivated young individuals from various backgrounds to develop a vision for the future. Together, we want to imagine the potential characteristics and features that money could or should have in the future.

Q: IN TERMS OF MONEY, WHERE ARE WE CURRENTLY, AND WHERE ARE WE HEADED?

BH: The first wave of digitalization has already passed in the Western world. ATMs and credit cards have been around since the late 1970s, well before the widespread use of the Internet and mobile phones. This model is closely tied to traditional banks or payment service providers. It functions reasonably well, enjoying a high level of trust in the population. However, it’s becoming outdated, incurring high transaction costs, and primarily serves users in industrialized countries controlled by them.

The second wave is characterized by a strong trend of digitization in emerging economies, where annual growth in cashless payments exceeds 20%. Overall, the share of cash payments has decreased by nearly 25% in the world’s major markets over the last decade.

Q: HOW DO YOU ASSESS THESE TRENDS?

BH: It is important to differentiate between payment systems and money here.

In payment systems, we observe the emergence of two new trends alongside the traditional ATM and credit card systems. Firstly, there are systems like AliPay and WeChat Pay, operated by large corporations, which have become standard payment methods in China. Secondly, we are witnessing the establishment and rapid growth of open alternatives like UPI in countries like India and Brazil.

Regarding money, we often see attempts to create new currencies, but with limited success so far. With crypto assets like Bitcoin, we now know that they only partially fulfill a fundamental function of money – value transfer – due to technical shortcomings. Therefore, it wouldn’t be appropriate to call crypto assets money. Even Facebook’s attempt to create a new global currency with Libra failed due to resistance from regulators and the public.

Q: WHEREVER THE JOURNEY GOES, WHAT DO WE NEED TO CONSIDER IN ANY CASE?

BH: We must ensure that we can actively shape future payment systems and currencies while safeguarding fundamental rights like data privacy. Financial transactions involve sensitive data points that reveal a lot about our lives. We need to be proactive from the start, engage deeply with this topic, and ideally design such systems ourselves.

Q: SOME EXPERTS BELIEVE CASH WILL DISAPPEAR. DO YOU AGREE WITH THIS ASSESSMENT?

BH: Yes, I believe it’s a natural technological evolution.

Q: IF SO, WHAT DOES THAT MEAN FOR OUR SOCIETY?

BH: Change, much like in many other aspects of life. This won’t happen overnight; it’s a gradual process advancing at different speeds. We have the advantage of observing countries like Sweden, where this process has progressed significantly since the introduction of Swish. Recent years have shown how adaptable we are and how change can open new possibilities and doors.

Q: WHAT WILL REPLACE CASH?

BH: New digital tools for conducting transactions and potentially, far in the future, new forms of currencies controlled by other actors.

Q: GIVEN THAT, WHAT TERMS SHOULD WE START TO FAMILIARIZE OURSELVES WITH?

BH: In the realm of crypto assets, “Decentralized Finance (DeFi)” is the most intriguing topic for me currently. It involves attempting to build partially high-risk financial products on digital assets with no intrinsic value. The complexity of these products is enormous, and right now, nobody fully understands how these products or services are interconnected, who controls them, and what risks are associated.

Q: THE EU COMMISSION CURRENTLY WORKS ON THE DIGITAL EURO. WHERE DO WE STAND, AND WHAT WILL THE IMPLICATIONS BE?

BH: I believe there is much more to come. Personally, I still find the topic somewhat abstract. I’m not entirely clear on how the digital Euro will be implemented and who will benefit. Currently, I get the impression that we will continue using our familiar electronic means of payment, and we may not be greatly affected by the digital Euro. It might primarily be a technology for interbank and bank transactions.

Q: CENTRAL BANKS OR FINANCE MINISTRIES – WHOSE ROLES WILL CHANGE IN THE FUTURE?

BH: That depends on the direction future forms of money and payment services take. Global corporations might resume their efforts to create their own global currencies. If this model prevails, central banks and political decisions may play a less ordered role. Such a development, which I see as somewhat dystopian – due to the loss of currency sovereignty – would have significant consequences for nation-states.

However, currently, we see globally that central banks, in collaboration with the banking sector, can play a very active and influential role. The National Payments Association in India, which is behind the Unified Payment Interface, or current developments in Sweden, are very inspiring, in my opinion.