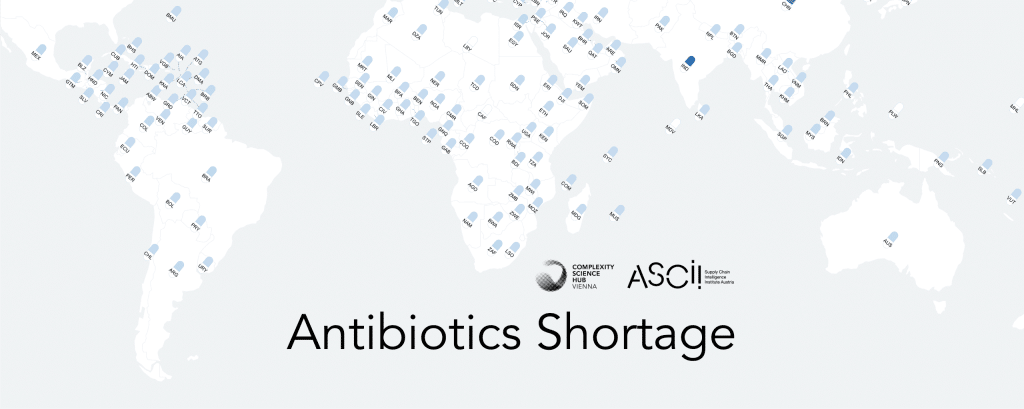

WHY DOES THE WORLD SEEM TO SUDDENLY BE FIGHTING OVER ANTIBIOTICS?

A new study around Peter Klimek of the Complexity Science Hub and the ASCII provides insights.

THE CONCENTRATION OF THE MARKET ON CHINA AND INDIA

1. There is a clear trend of increasing concentration of production in a few countries, namely China and India: The development of production concentration accelerated during the pandemic. Systemic trade risk indicators for China and India show sharp increases after 2018. These dependencies are not directly visible in import relationships but can be unravelled by tracing the production processes backwards along the antibiotics value chain.

2. The production concentration is more pronounced in upstream stages of the value chain (intermediaries and active pharmaceutical ingredients, APIs) rather than in downstream stages like unpackaged and packaged products. 76% of the manufacturing sites of intermediaries are located in China and India. 59% of API (active pharmaceutical ingredients) producers are situated in these countries.

3. Due to a higher production concentration in intermediaries and APIs, shocks affect APIs more strongly than packaged products. Hence, it becomes harder to find suitable substitutes when confronted with a shortage. In line with this observation, the estimated number of shortages that could be resolved by substitution halved in 2020. Negative impacts on patient care increased.

4. The data suggests a tendency towards market segmentation in which firms in European and North American countries developed an increasing dependence on Chinese suppliers. Indian producers trade mostly with local neighbours in Asia, Oceania and African countries.

SARS-COV-2 LED TO REDUCED NEED FOR ANTIBIOTICS

1. When the pandemic hit, non-pharmacological interventions aimed at curbing the spread of SARS-CoV-2 also reduced the circulation of other pathogens. Consequently, both community and hospital demand and consumption of antibiotics dropped sharply during the pandemic (by approximately 20%).

2. Reducing contagion risks, hospitals restricted their services to non-COVID patients. Drug shortages in hospitals nearly halved during the pandemic compared to the frequency of shortages in 2018. This uncovered improvement potential in inventory management and demand forecasting.

3. In 2022, in an increasing number of countries, SARS-CoV-2 related containment measures ceased. As societies by and large “returned to normal” so did antibiotic consumption. Volatile demand and geographically concentrated production systems led to simultaneous shortages of antibiotics across many parts of the world.

BACKGROUND

1. Supply disruption of medications in general, and antibiotics in particular, are not a new phenomenon. Since 2014, they have steadily increased in frequency and severity. In the vast majority of cases, it was possible to resolve these shortages by finding suitable substitutes and thereby reduce negative impacts on patients.

2. The consumption of antibiotics declined in many European countries between 2011 and 2018. This is welcome as it reduces the build-up of antimicrobial resistance.

3. These trends in antibiotics demand coincided with structural transformations in the antibiotics production system. Overall, there is a clear trend of increasing geographic concentration of production. Production sites in China and India have benefitted from this trend.

POLICY CONSIDERATIONS TO AVOID ANTIBIOTIC SHORTAGES IN THE FUTURE

1. There are short-term and long-term remedies. Short-term remedies include improvements in the data, planning and forecasting infrastructure. This will require additional investments. Supply chain disruptions can reflect market structure problems. Long-term policies address the market structure and the international division of labour.

2. Existing supply networks arise from market processes that reflect a competitive combination of qualities and prices. Deviating from market results comes at a cost which can be interpreted as an insurance premium that health agencies need to incur to avoid impacts on patients. Additional costs require appropriate financing. Ideally, a well-designed market should internalise the risk of disruption, e.g., through appropriate contracts with the adequate incentive structures.

3. Antibiotics shortages need to be considered against the backdrop of the global risk of antimicrobial resistance. Ideally, policy remedies should address both issues.

REMEDIES

1. Understand the scope of the problem. Data availability is an issue. Efforts need to be undertaken to not only track and forecast drug shortages, but to focus on shortages of non-substitutable drugs.

2. Demand forecasting and stable supplier relationships. Health authorities need to better understand the demand developments for antibiotics in the population. Evidence-driven demand planning could form the basis for building stable supply relationships, e.g., through multiyear contracts with producers that contain robust provisions in case of non-delivery.

3. Capacity markets and excess inventory. In case of emergencies, add-on production capacities that timely provide the drugs in question may address arising shortages from the outset.

4. Single Market. The European Union provides a powerful tool to mitigate supply risks across multiple players through the Single Market. Coordinated and more centralised EU inventories can also help to reduce overall safety stock and thereby avoid inefficiencies.

5. Bargaining power. Countries, regions, or health agencies might consider deeper cooperation and pursue joint forecasting and joint procurement strategies. Adverse effects on the market structure of suppliers and possibly anti-competitive behaviour of suppliers need to be monitored.

6. Diversification of supply. Diversification requires internationally competitive producers. Hence, the debate about broadening the supplier base is embedded in a wider discussion about competitiveness and structural change.

7. Subsidised procurement prices. Reimbursement models that delink development costs from unit sales have been proposed to tackle drug shortages.

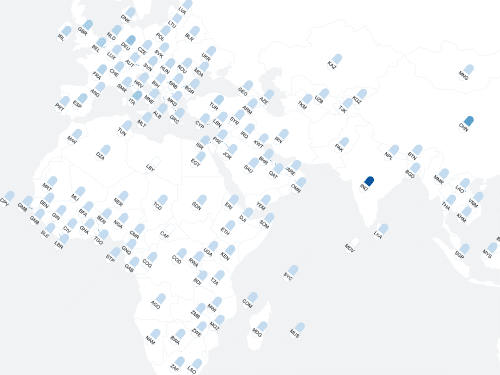

In the interactive visualization, created by Liuhuaying Yang of the Complexity Science Hub, you can explore the connections and interdependencies for yourself. This video shows how it works.